Introduction

Digital transformation has reshaped every area of modern business, from communication and marketing to operations and finances. As companies adopt new technologies, financial management becomes one of the most critical areas requiring modernization. In a world driven by automation, speed, and data, businesses need tools that can help them handle financial tasks more intelligently and efficiently. This is where Payro emerges as a groundbreaking solution.

Payro represents a new era of financial technology—a smart platform designed to simplify financial processes, automate transactions, enhance reporting, and provide real-time insights. It is built for modern businesses that require transparency, accuracy, and speed in their financial operations. Understanding Payro is essential for organizations that want to stay competitive, agile, and financially resilient in today’s digital economy.

In this article, we will break down everything about Payro: what it is, how it works, the problems it solves, its features, advantages, applications, and why it matters so much in this rapidly evolving digital landscape.

1. What Is Payro?

Payro is a modern financial management platform designed to streamline and automate key financial processes. It integrates budgeting, payment processing, expense tracking, reporting, payroll, and financial analytics into a single unified system.

Payro brings together:

- Intelligent automation

- Real-time data tracking

- Smart financial tools

- Secure digital transactions

- Analytical insights

Its goal is simple: to help businesses manage finances more efficiently, reduce operational workload, and support data-driven strategic decision-making.

2. The Purpose and Vision Behind Payro

Payro was developed for professionals, businesses, and financial teams facing these modern challenges:

- Increasing financial complexity

- Too much manual work

- Lack of real-time insights

- Multiple fragmented financial tools

- Slow and inaccurate reporting

- Growing compliance requirements

- Higher demand for automation

2.1 Payro’s Core Vision

Payro aims to transform financial management by providing:

- Simplicity

- Transparency

- Automation

- Insights

- Speed

- Security

Its design is built around empowering users—not overwhelming them with data or complicated systems.

3. Why Payro Matters in Today’s Digital Economy

Payro is not just another financial tool; it is a product built for modern business environments. In a digital economy driven by speed and automation, organizations must evolve their financial systems.

3.1 The Shift Toward Automation

Businesses today rely heavily on automation to:

- Reduce costs

- Improve accuracy

- Gain efficiency

- Accelerate decision-making

Payro supports this shift by automating repetitive financial tasks.

3.2 Demand for Real-Time Data

In the past, financial data was delivered weekly or monthly. Now, companies need:

- Instant insights

- Live reporting

- Up-to-date forecasting

Payro fills this gap with real-time dashboards.

3.3 Rising Need for Integration

Using multiple disconnected financial tools slows down operations. Payro solves this through a centralized ecosystem.

3.4 Data-Driven Decision Making

Businesses no longer rely on guesswork; they depend on analytics. Payro provides intelligent insights that strengthen financial strategies.

3.5 Stronger Compliance Requirements

In today’s regulatory environment, companies need accurate, secure, and traceable financial systems. Payro helps meet these standards.

4. Key Features of Payro

Payro is loaded with advanced features built to modernize financial operations from the ground up.

4.1 Smart Automation Engine

Payro automates:

- Payroll

- Billing cycles

- Invoice creation

- Expense classification

- Monthly reporting

- Payment reminders

- Tax preparation tasks

This helps businesses save time and reduce human error.

4.2 Real-Time Financial Dashboard

The dashboard offers:

- Cash flow updates

- Expense tracking

- Revenue monitoring

- Balance overviews

- Live financial alerts

- KPI tracking

Users can instantly see their full financial picture.

4.3 Integrated Payment System

Payro supports:

- Online payments

- Auto-pay features

- Digital invoicing

- Multi-method transactions

- Scheduled payments

All transactions are secure and recorded in real time.

4.4 AI-Driven Financial Insights

Using pattern recognition and historical data, Payro helps users:

- Predict cash flow

- Identify financial risks

- Recognize spending patterns

- Optimize budgets

- Forecast growth

This transforms raw data into actionable insights.

4.5 Expense Management Tools

Payro automatically:

- Detects expenses

- Categorizes them

- Matches receipts

- Tracks spending habits

This simplifies both operational and personal financial planning.

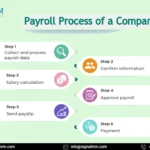

4.6 Payroll Management

Payro makes payroll effortless by:

- Calculating salaries

- Managing taxes

- Processing bonuses

- Tracking attendance integrations

- Generating payroll reports

This removes the need for multiple payroll tools.

4.7 Multi-Level Access and Permissions

Payro supports:

- Admin roles

- Department-level access

- Employee self-service portals

- Permission-based data visibility

This ensures transparency and privacy across teams.

4.8 Bank and Software Integration

Payro connects to:

- Bank accounts

- Accounting software

- E-commerce systems

- HR platforms

- Tax tools

This centralizes financial data for easy monitoring.

5. Advantages of Using Payro

Payro offers major advantages that significantly impact business performance and financial outcomes.

5.1 Higher Accuracy, Lower Errors

With automation and data validation techniques, Payro ensures:

- Clean data

- Reliable reporting

- Fewer miscalculations

Accurate finances help businesses grow with confidence.

5.2 Improved Financial Visibility

Payro provides full financial clarity through:

- Real-time views

- Automated reports

- Transparent budgeting

This improves decision-making quality.

5.3 Reduced Manual Workload

Teams can cut down on:

- Manual data entry

- Repetitive tasks

- Complex paperwork

Allowing them to focus on more strategic tasks.

5.4 Enhanced Security and Compliance

Security features include:

- Encryption

- Fraud detection

- Access control

- Secure data storage

These protect business information and support compliance.

5.5 Cost Efficiency

Payro helps businesses save money by:

- Eliminating redundant tools

- Reducing labor hours

- Preventing financial mistakes

- Increasing operational efficiency

5.6 Scalability for Any Business Size

Whether a small startup or a large enterprise, Payro:

- Adapts to user growth

- Handles increasing workloads

- Scales features as needed

It grows together with the business.

6. Who Can Benefit From Payro?

Payro is built for multiple audiences across industries.

6.1 Small Businesses

To manage:

- Cash flow

- Payroll

- Payments

- Budgets

Small businesses gain huge efficiency improvements.

6.2 Medium and Large Enterprises

Enterprises use Payro for:

- Multi-team financial operations

- Advanced analytics

- High-volume data processing

- Compliance management

6.3 Freelancers & Independent Professionals

They can use Payro for:

- Invoicing

- Expense tracking

- Tax preparation

- Payment management

6.4 E-Commerce Businesses

Perfect for:

- Online payments

- Sales tracking

- Inventory cost analysis

- Vendor payments

6.5 Finance Departments & Accountants

They benefit from:

- Accurate financial data

- Automated reconciliation

- Professional reporting

7. Why Payro Is Different From Traditional Tools

7.1 Unified Ecosystem

Instead of several apps, everything is in one platform.

7.2 AI and Predictive Analytics

Traditional tools only show data—Payro interprets it.

7.3 Fast, Modern, User-Friendly

Interface designed for quick learning and simplicity.

7.4 Smart Notifications

Users receive real-time alerts about financial updates.

7.5 Future-Proof Design

Built to grow with digital transformation.

8. The Future of Payro in the Digital Economy

Payro is expected to play an even bigger role in the future by incorporating:

- Advanced AI forecasting

- Global financial integration

- Smart automation enhancements

- Sustainable finance tools

- Deeper business analytics

- Voice-command financial management

Payro is not just adapting to the digital economy—it is becoming a driving force in shaping it.

Conclusion

Payro represents the next generation of financial management: intelligent, automated, secure, and built for modern businesses. It simplifies complex financial workflows, enhances accuracy, strengthens decision-making, and provides a seamless user experience.

In today’s digital economy—where speed, automation, and data insights are essential—Payro stands out as a powerful solution that helps businesses operate smarter, faster, and more effectively.

Whether you’re a business owner, financial manager, freelancer, or enterprise leader, Payro offers the tools needed to stay competitive in a rapidly evolving financial landscape.

Tinggalkan Balasan